Meeting Tips

Radzivon Alkhovik

Jan 27, 2026

·

Updated on

Jan 27, 2026

The sales department conducts 200 client meetings a month. The manager asks why conversion is 15% while competitors achieve 25%. Answers are vague — "clients aren't ready," "price is too high," "long deal cycle." Nobody can say exactly at which stage clients are lost and why.

Without meeting analysis, sales are built on intuition and luck. One rep closes 30% of meetings, another 10%, but nobody knows what the difference is. Successful techniques aren't replicated, mistakes repeat, and training newcomers happens through trial and error.

The mymeet.ai team works with sales departments that turn meeting analysis into a system for improving results. Data from every meeting shows what works, what doesn't, and where money is being lost.

Why Analyze Client Meetings

A client meeting is a black box for most companies. They only know the outcome — bought or didn't buy. What happened inside the meeting remains a mystery.

What Systematic Meeting Analysis Provides

Analysis turns intuition into knowledge. Instead of feeling "I think I conducted the meeting well," you get facts. Did you ask 15 clarifying questions or 2? Did the client speak 60% of the time or 20%? What objections were voiced and how did you respond?

Identifying success patterns. When you analyze 50 meetings, you see patterns. Deals close when the rep spends the first 10 minutes on discovery rather than product presentation. Or when a specific case study is mentioned in the conversation. These patterns can be replicated.

Personalized team training. Abstract "how to sell" training works poorly. Analyzing a specific rep's meeting with indication of where they lost the client works far more effectively.

The Difference Between Intuition and Data

The rep feels the meeting went well. The client actively nodded, asked questions, and said goodbye in a friendly manner. Subjective assessment — 8 out of 10. A week later, the client declines without explanation.

Data shows a different picture. The rep spoke 75% of the time — a monologue instead of a dialogue. Gave superficial responses to three client objections without clarification. Didn't mention the key need voiced at the beginning in the solution. Objective assessment — 4 out of 10.

Intuition deceives especially experienced reps. The longer you work, the more confident you are in your techniques, even if they don't work. Data doesn't let you rest on your laurels.

Impact of Analysis on Sales Conversion

Sales departments that systematically analyze meetings show conversion 15-40% higher than those that don't. The difference isn't in rep talent but in conscious process improvement.

Analysis provides three competitive advantages:

Fast training of new employees using real examples of successful meetings

Replicating working techniques from top performers across the entire team

Early identification of funnel problems before they kill the quarterly plan

Key Client Meeting Metrics

You can't improve what you don't measure. Metrics turn subjective feelings about meeting quality into objective indicators.

Quantitative Metrics

Conversion of meetings to the next funnel stage — the main effectiveness metric. What percentage of first meetings lead to presentations? How many presentations to proposals? How many proposals for closed deals?

Typical B2B sales funnel:

First meeting → Presentation: 40-60%

Presentation → Proposal: 50-70%

Proposal → Closed deal: 20-40%

If your numbers are significantly lower, the problem is in meeting quality at the corresponding stage.

Talk/listen ratio shows who dominated the conversation. The optimal ratio for most meetings — client speaks 55-70%, rep speaks 30-45%.

If the rep speaks 70%+ of the time, it's a monologue, not a sale. The client isn't engaged, their needs aren't identified. Conversion of such meetings is low.

Meeting duration vs planned time. If the meeting runs significantly longer than planned — either there's no process control, or the client is genuinely interested and asking many questions. Context matters.

Number and type of questions asked. Open questions (require detailed answers) vs closed (yes/no). Top reps ask an average of 11-15 questions per meeting, 70%+ of which are open.

Qualitative Indicators

Client engagement is measured indirectly — do they ask questions, clarify details, share information about their business. A passive client who only listens and nods is a bad sign.

Identified objections and handling them. Objections are good — they show interest and give the opportunity to address doubts. It's bad when objections aren't voiced in the meeting but surface later as reasons for declining.

Metric — how many objections were identified, how many were addressed in the meeting, how many remained open.

Emotional tone of conversation. Modern speech-to-text analysis tools determine tonality — positive, neutral, negative. If the client's tonality dropped at a certain moment in the meeting, that's where the problem is that needs to be examined.

Process Metrics

Following meeting structure. A good meeting has clear structure — introduction, need identification, solution presentation, objection handling, next steps. Metric — how much time was spent on each stage.

Typical mistake — the rep immediately starts presenting the product (30 minutes) while spending 5 minutes on need identification. It should be the opposite.

Specificity of agreements. At the end of the meeting, there should be clear next steps with dates and responsible parties. "We'll call next week" is vague. "Meeting with your IT director Thursday at 3 PM" is specific.

Metric — percentage of meetings that ended with specific agreements with dates.

Metrics at Different Sales Funnel Stages

Each sales stage has its critical metrics. What's important at the first meeting differs from what's important when closing a deal.

First Contact — What to Measure

The main task of the first meeting is to qualify the lead and get the next meeting. Not to sell, but to determine if there's a fit between your solution and the client's needs.

Key first meeting metrics:

Time on discovery (identifying client situation) — should be 50-60% of the meeting

Number of open questions about the client's business — minimum 8-10

Whether budget, decision-making process, timeline were identified

Conversion to next meeting — norm is 40-60%

If first meeting conversion is low, the problem is usually insufficient discovery. The rep didn't identify the real need or wasn't convinced of the solution 's relevance.

Product Presentation — Key Indicators

At the presentation stage, the client is already qualified. The task is to show how your solution addresses this specific client's needs.

Critical presentation metrics:

Customization for the client — are the client's specific problems mentioned

Use of case studies from similar companies

Product demo vs talking about it — demo is more effective

Number of objections and percentage addressed in the meeting

A good presentation generates objections. If the client is silent and doesn't ask questions — either they're not interested or didn't understand the value. Objections show the client is thinking about buying.

Objection Handling — Success Indicators

Objections are a critical meeting moment. How the rep responds to client doubts determines the deal outcome.

Objection handling metrics:

Response technique — defending and arguing vs asking clarifying questions

Time spent addressing the objection — superficial answer vs deep discussion

Does the objection repeat — if yes, it wasn't addressed

Conversion of meetings with objections vs without objections

Paradoxically, meetings with objections convert better than meetings without them. Absence of objections often means absence of real interest.

Deal Closing — Final Metrics

In the final meeting, terms, price, implementation timeline, and contract details are discussed. The client has already decided to buy, the question is in the details.

Closing metrics:

Specificity of next steps — who, what, when

Identifying final purchase barriers

Time from final meeting to contract signing

Percentage of deals that reached this stage and didn't close

Metrics by deal stage:

Funnel Stage | Key Metric | Norm | Red Flag |

First contact | Time on discovery | 50-60% of meeting | <30% of meeting |

First contact | Conversion to presentation | 40-60% | <25% |

Presentation | Talk/listen ratio | Client 55-70% | Rep 70%+ |

Presentation | Objections identified | 2-4 per meeting | 0 objections |

Presentation | Conversion to proposal | 50-70% | <30% |

Objection handling | Objections addressed | 70-80% | <50% |

Closing | Proposal to deal conversion | 20-40% | <15% |

Closing | Time from proposal to decision | 7-21 days | 45+ days |

How to Collect Meeting Data

Systematic analysis requires systematic data collection. One-off meeting recordings don't create a base for analysis.

Meeting Recording and Transcription

Meeting recording gives a complete picture of what was discussed. Memory distorts — a day after the meeting you remember 50% of details, a week later 20%.

Get client consent for recording at the beginning of the call. "For quality purposes and to document agreements, I'm recording our meeting, do you mind?" Most clients agree.

Transcription allows analyzing the meeting without repeatedly watching the recording. You can search for keywords, see conversation structure, count questions and objections.

CRM and Results Documentation

CRM is the database for storing metrics from each meeting. After the meeting, the rep fills in fields — identified needs, objections, next steps, deal probability assessment.

The CRM problem — reps hate filling them out. Data is entered formally just to check the box, losing value. Collection automation is critical.

Minimum fields to document:

Funnel stage after meeting

Identified needs (structured list)

Objections and status (open/closed)

Next step with date

Meeting quality assessment (1-10)

Client Feedback Surveys

Client feedback shows how the meeting looked from the other side. The rep may think everything went great, the client thinks otherwise.

A short post-meeting survey (3-5 questions) with assessment of meeting usefulness, proposal clarity, and readiness for next steps provides valuable data.

Response rate is low (10-20%), but even this data helps adjust the approach.

Automatic Data Collection

Manual data collection doesn't scale. If a rep conducts 10 meetings a week, spending an hour after each on detailed documentation is unrealistic.

Automation through meeting recording and analysis tools removes the burden from reps. The system extracts key metrics itself — just review and supplement.

Analyzing Successful Meeting Patterns

The main value of data is identifying patterns that correlate with success. What do meetings that ended in deals have in common?

Comparing Won and Lost Deals

Take 20 won and 20 lost deals. Review recordings of key meetings or read transcripts. Look for systematic differences.

Typical findings:

In won deals, the rep asked 50% more questions about the client's business

In lost deals, the key objection surfaced at the third meeting, though signs were there at the first

In won deals, a specific case study was mentioned in 80% of cases

These patterns become the basis for changing the entire team's approach.

What Top Sales Reps Do Differently

Every sales department has 20% of reps who close 60-70% of deals. They don't work more, they work differently.

Analysis of top rep meetings shows:

They spend significantly more time identifying the client's situation before presenting

They ask second-level questions — "And why is that important to you?" after each answer

They use storytelling — every product feature is supported by a client story

They handle objections through questions, not defense

Replicating top rep techniques across the entire team raises average performance.

Key Moments That Influence Decisions

Research shows — clients make purchase decisions not at the end of the funnel but much earlier. Often at the first or second meeting, an opinion forms, then comes rationalization.

Critical meeting moments:

First 5 minutes — establishing trust and expertise

The moment when the client realizes the problem's scale (often through the rep's questions)

A case study from a company similar to the client — recognizing themselves in the story

Response to the main objection — if addressed convincingly, the deal moves forward

Analyzing these moments in meeting recordings shows exactly where the client made their decision.

Qualitative Analysis of Client Conversations

Numbers are important but don't tell the whole story. Qualitative conversation content analysis gives understanding of what's behind the metrics.

Analyzing Questions the Rep Asks

Question types reveal rep experience. Newcomers ask closed questions "Do you have a CRM?" Experienced reps ask open questions "How is your client relationship process currently organized?"

Question categories for analysis:

Questions about the current situation — "How do you currently solve this task?"

Questions about problems — "What doesn't work in the current approach?"

Questions about consequences — "How does this affect the business?"

Questions about selection criteria — "What's important to you in a solution?"

Questions about the decision process — "Who else is involved in the selection?"

Top reps ask questions from all categories. Weak reps focus only on the first category.

Objection Handling — Effective Patterns

The "too expensive" objection can be handled differently. A weak rep starts defending and justifying the price. A strong one asks "What are you comparing to?" or "Let's calculate the ROI together."

Pattern for effective objection handling:

Clarification — "Tell me more, what do you mean?"

Empathy — "I understand your concern"

Reframing — "So the question is about return on investment?"

Response through question or case study

Verification — "Does this address your concern?"

Recording analysis shows which reps follow this pattern and which start arguing immediately.

Language and Formulations That Work

Certain phrases correlate with deal success. Analysis of hundreds of meetings reveals these phrases.

Formulations that work:

"Tell me more about..." (invitation to dialogue)

"If I understand correctly..." (paraphrasing to verify understanding)

"Company X from your industry faced a similar situation..." (relevant case)

"Let's look at how this will work specifically for you..." (personalization)

Formulations that don't work:

"We have the best solution on the market" (unsubstantiated claim)

"All our clients are satisfied" (non-specific)

"That's impossible" (refusal without alternative)

"Yes, but..." (invalidating the client's words)

Nonverbal Signals (for Video Calls)

In video calls, nonverbal signals are available — facial expressions, body language, tone of voice. They often say more than words.

Interest signals:

Leaning toward the camera during solution discussion

Active facial expressions, nods

Notes the client takes

Additional people the client invites to the call

Loss of interest signals:

Leaning back, crossed arms

Distraction with other things, looking away

Short answers without developing the thought

Speeding up speech toward the end — wants to finish

Nonverbal analysis helps identify the moment when the meeting went off track.

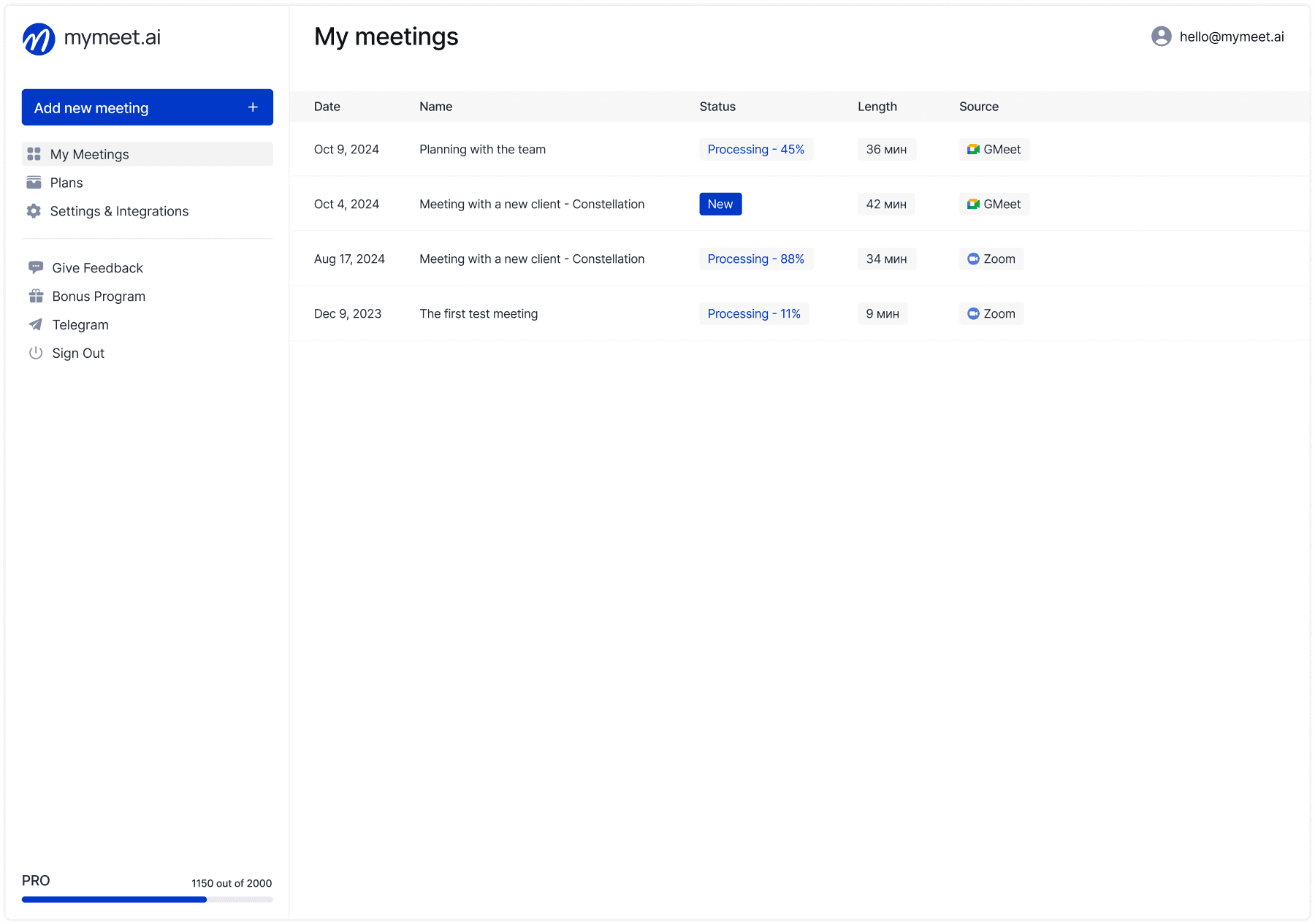

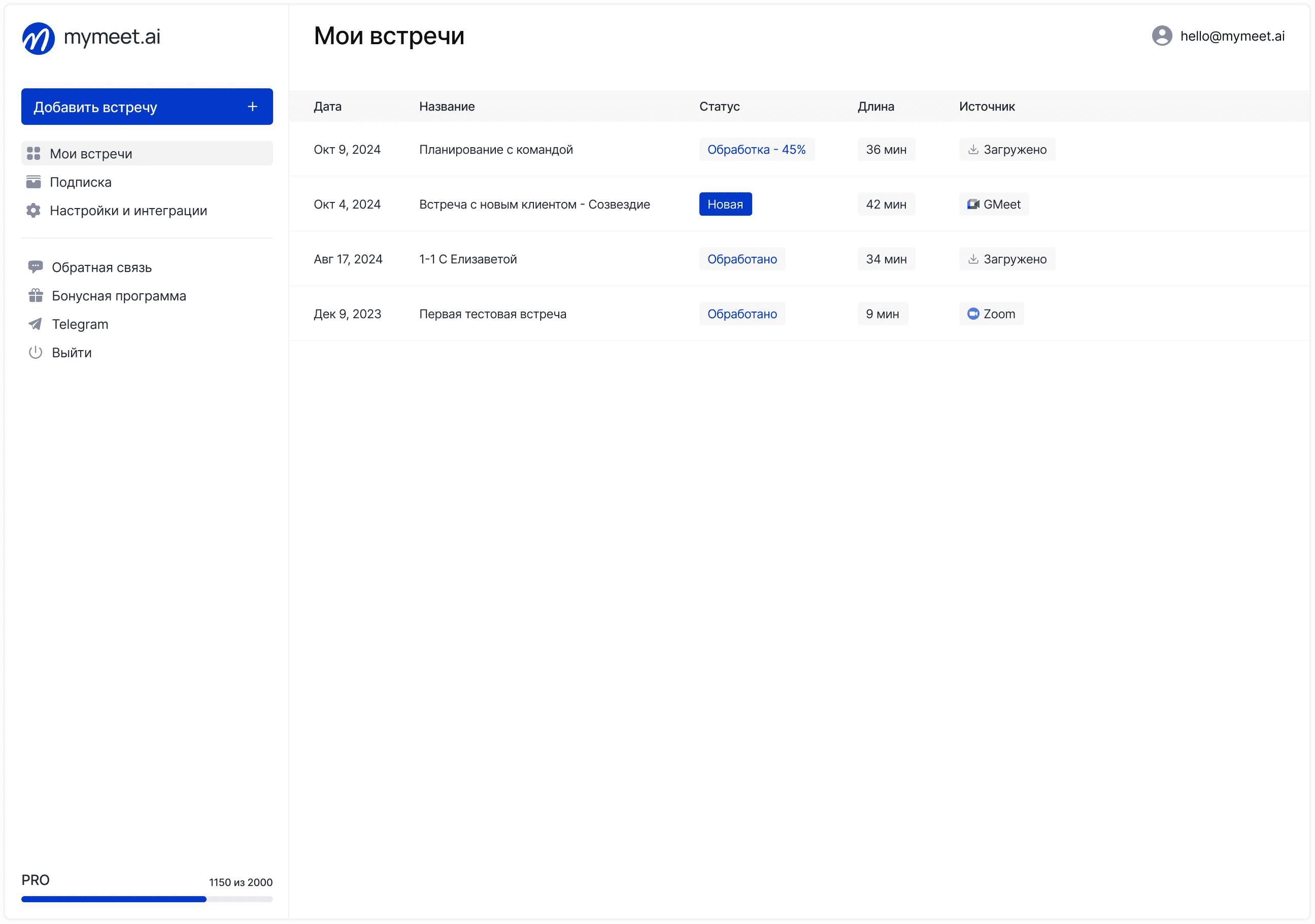

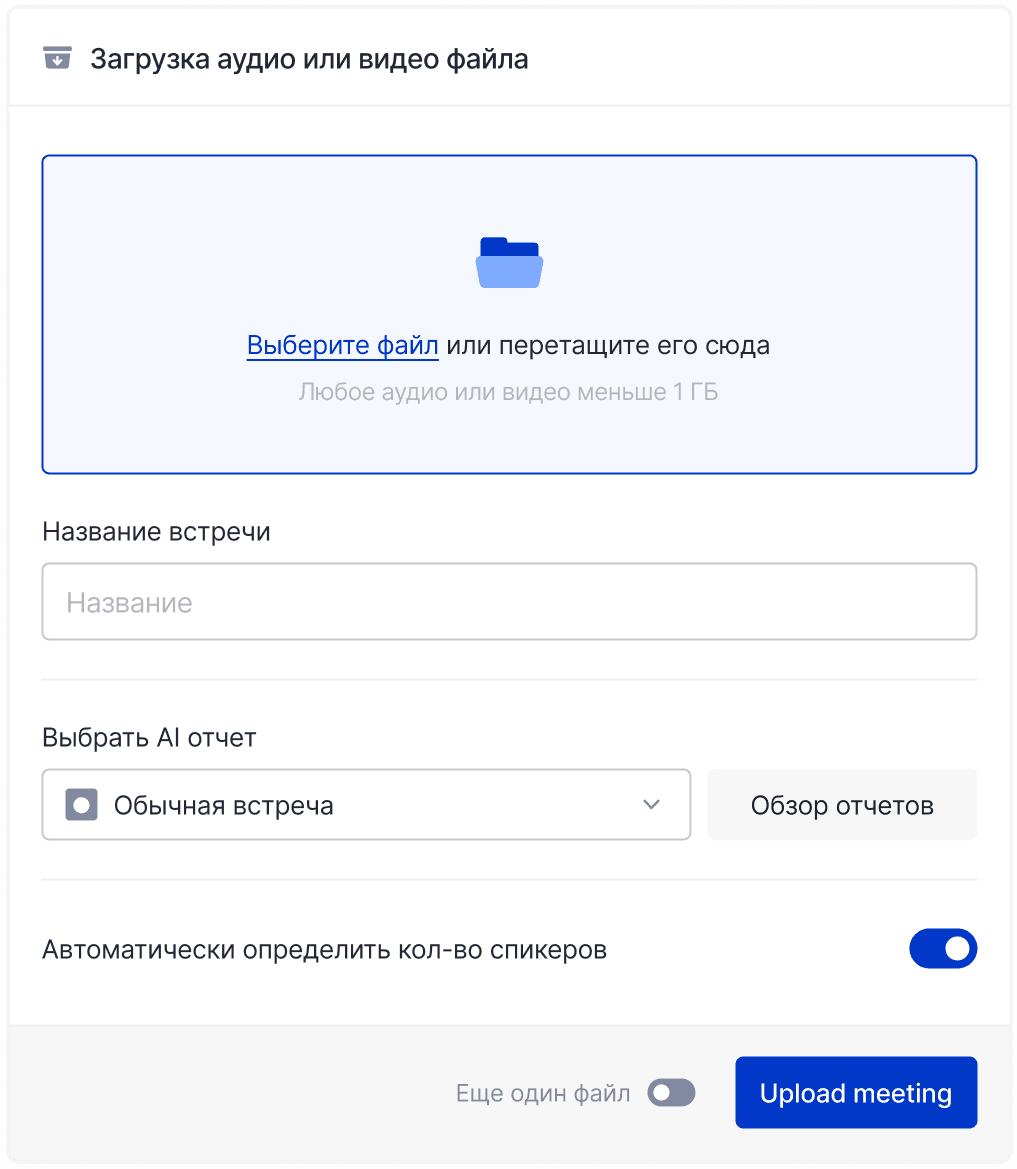

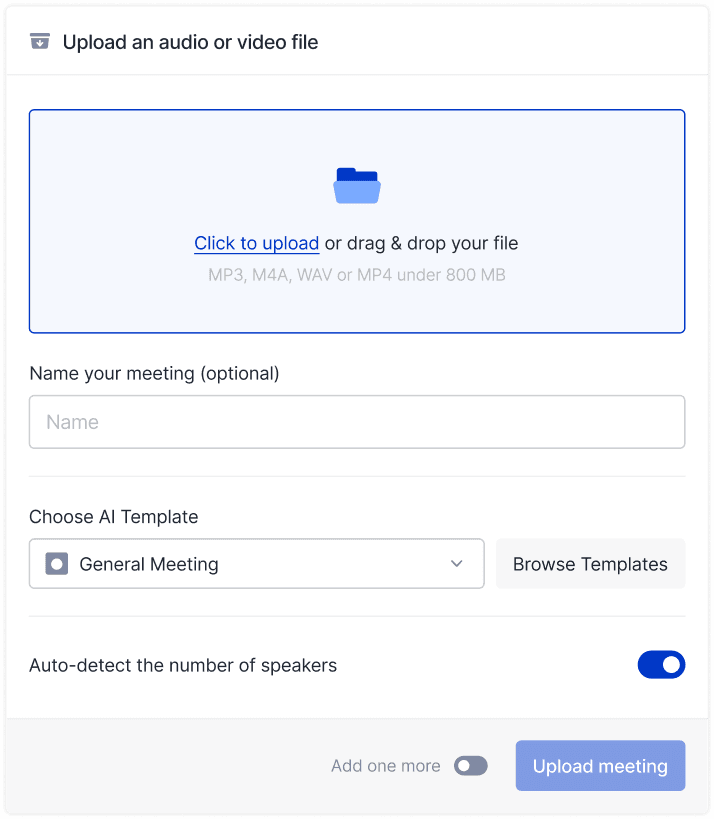

mymeet.ai for Client Meeting Analysis

Manual analysis of every meeting is unrealistic for a sales department with dozens of meetings per week. Tools that automate data collection and provide insights are needed.

mymeet.ai is an AI meeting assistant that automatically records online calls, creates detailed transcripts with speaker separation, and analyzes conversation content. The system extracts key metrics, objections, agreements, and communication patterns.

mymeet.ai capabilities for client meeting analysis:

✅ Automatic transcription with speaker separation — see exactly who said what and when, can calculate talk/listen ratio

✅ Extraction of client objections and questions — AI finds all moments where the client expressed doubt or asked about the product

✅ Analysis of successful meeting patterns — system compares won and lost deals, identifying approach differences

✅ Meeting quality metrics — number and type of rep questions, time spent on each meeting stage, agreement specificity

✅ Search across all meetings — can find how different reps responded to a specific objection and choose the best approach

✅ New rep training — recordings of top reps' best meetings with analysis become training material

✅ Automatic reports for managers — weekly team metrics summary without manual data collection

✅ CRM integration — key meeting information automatically goes into the deal card

Case Study: How a Sales Department Increased Conversion by 23%

A B2B SaaS company's sales department of 8 reps conducted about 120 meetings per month with 18% conversion to deals. The manager didn't understand why some reps closed 28% of meetings while others closed 12%.

Implementing mymeet.ai to record all meetings enabled systematic analysis. First insight — reps with low conversion spent 70% of meeting time on product presentation, barely asking questions about the client's situation.

Analysis revealed a pattern — in successful meetings, the rep spent the first 15 minutes asking a series of questions about the client's current process, problems, and consequences. Only then did they move to presentation, using information from discovery.

The manager organized training based on recordings of the top rep's best meetings. Each rep analyzed their own recordings, comparing with successful meeting structure. After two months, the department's average conversion grew from 18% to 23% — 5 percentage points yielded 15 additional deals per quarter.

Additional effect — time for preparing weekly reports dropped from 4 hours to 30 minutes. The manager received automatic team metrics summaries.

How to Build a Meeting Analysis System in Your Company

One-off analysis of several meetings provides little value. The value is in a systematic process built into sales department operations.

Where to Start — Minimum Metric Set

Don't try to track 50 metrics at once. Start with a basic set that provides maximum insights with minimum effort.

Minimum metrics to start:

Conversion by funnel stages

Rep and client talk/listen ratio

Number of questions asked by rep

Identified objections and percentage addressed

Next step specificity (yes/no)

These five metrics provide 80% of the value. Add the rest later.

Regular Analysis Process

Weekly reviews — the sales manager selects 2-3 meetings for team review. One successful, one unsuccessful, one borderline. Discussion of what worked and what didn't.

Monthly metrics analysis — summary for the team and each rep. Who improved indicators, whose dropped, what common trends exist. Approach adjustment based on data.

Quarterly strategic review — deep analysis of all meetings for the quarter. Identifying systemic funnel problems, updating scripts and materials.

Data-Driven Team Training

Traditional sales training — abstract "how to handle objections" techniques using textbook examples. Low effectiveness because it's disconnected from reality.

Data-driven training — analysis of the rep's real meetings with specific clients. "Here the client voiced a price objection. You responded defensively. Let's see how Peter responded to the same objection last week."

Create a best practices library — meeting recordings with comments on exactly where the rep did something well. Newcomers study this library during onboarding.

Iterations and System Improvement

The analysis system should evolve. After three months, you'll understand which metrics really matter, which can be removed, which to add.

Collect team feedback — what helps, what takes time without benefit. Reps should see analysis value, not perceive it as control.

Tools for Client Meeting Analysis

The right tools make meeting analysis a scalable, systematic process rather than a one-time activity.

CRM Systems and Analytics

amoCRM, Bitrix24, Megaplan — popular CRMs in Russia with basic sales funnel analytics capabilities. They show conversion by stages, deal progression speed, and rep workload.

CRM limitation — they only show data that reps manually enter. The quality of this data is often low because filling it out is perceived as bureaucracy.

Recording and Transcription Tools

mymeet.ai — a comprehensive solution for recording, transcribing, and analyzing meetings with integration into popular video conferencing platforms (Zoom, Google Meet, Microsoft Teams, Yandex Telemost).

Advantages of specialized tools — automated data collection without rep involvement, AI content analysis, metrics and insights extraction.

Conversation Analysis Platforms

Modern platforms use AI to analyze not only what was said but how it was said. Tonality, emotions, successful conversation patterns.

Advanced analysis capabilities:

Identifying moments of client interest drop

Comparing different reps' approaches

Automatic identification of compliance risks (promises that shouldn't be made)

Improvement recommendations based on best practices

Tool Integration

Isolated tools create information silos. Meeting recordings in one system, CRM separately, analytics in a third place. Reps spend time switching between systems.

Integration is critical for efficiency. Meeting data automatically goes into the CRM. CRM metrics are used for meeting quality analysis. A closed data loop without manual work.

Conclusion

Client meeting analysis turns sales from an art into a science. Intuition remains important but is supplemented by data on what actually works.

Start with basic metrics — conversion, talk/listen ratio, number of questions, objection handling. Record meetings and analyze successful vs unsuccessful conversation patterns. Train the team on real examples, replicate top rep techniques.

Ready to build a meeting analysis system in your sales department? Try mymeet.ai free — 180 minutes of meeting processing without credit card. Get automatic metrics for each meeting and identify opportunities for 15-30% conversion growth.

FAQ

Which client meeting metrics are most important?

Five key metrics provide 80% of insights — conversion by funnel stages, talk/listen ratio (norm is 60/40 in the client's favor), number of open questions (minimum 10 per meeting), percentage of objections addressed, and next step specificity. Start with these, add the rest later.

How do you analyze meetings if there's no recording?

Without recording, analysis is subjective and inaccurate. At minimum — detailed notes immediately after the meeting documenting client questions, objections, and agreements. But memory distorts details. Meeting recording with client consent provides an objective picture for analysis.

Should all client meetings be recorded?

Yes, if you want systematic analysis. Selective recording doesn't provide statistically significant data. Get consent at the beginning of the call — most clients agree if you explain the recording is for quality purposes and documenting agreements.

How often should meeting analysis be conducted?

Weekly — review of 2-3 representative meetings with the team. Monthly — metrics overview for all reps. Quarterly — deep analysis of all meetings to identify systemic problems. Frequent analysis turns insights into improvements faster.

What's a good meeting-to-deal conversion rate?

Depends on industry and deal cycle. For B2B SaaS, norms are — first meeting to presentation 40-60%, presentation to proposal 50-70%, proposal to deal 20-40%. Overall conversion from first meeting to close is 15-25%. If your numbers are lower, there's room for improvement.

How do you analyze client nonverbal signals?

In video calls, watch body language and facial expressions. Leaning toward the camera, active nods, note-taking — interest signals. Leaning back, crossed arms, distraction — loss of interest. Analyze the moment nonverbal signals change — that's where something went wrong or, conversely, struck a chord.

Can meeting analysis be automated?

Yes, modern AI tools automatically extract metrics — talk/listen ratio, number of questions, objections, agreements. They free reps from manual documentation. Managers get ready reports instead of collecting data manually.

How do you use analysis for training new reps?

Create a library of top reps' best meeting recordings with comments on exactly where a good technique was applied. Newcomers study real examples instead of abstract techniques. Review their first meetings, comparing with successful meeting structure.

What tools are needed for meeting analysis?

At minimum — a meeting recording and transcription tool (mymeet.ai), CRM for data storage (amoCRM, Bitrix24). Additionally — a conversation analysis platform with AI. The main thing is integration between tools so data flows automatically without manual work.

How do you measure question quality in a meeting?

Count the number and type of questions. Open questions (require detailed answers) are better than closed (yes/no). Questions about problem consequences are deeper than questions about symptoms. Top reps ask 11-15 questions per meeting, 70%+ of which are open. This is the benchmark for the team.

Radzivon Alkhovik

Jan 27, 2026