Meeting Tips

Andrey Shcherbina

Oct 13, 2025

SaluteJazz integrates with Sber ecosystem and can use banking AI technologies for meeting analysis, but only 15% of users know about these capabilities — proper configuration transforms corporate video conferencing into an intelligent platform with AI assistants at the level of Russia's largest bank.

Hello! The mymeet.ai team studied Sber ecosystem capabilities for corporate video conferencing. We'll show you services used by banks, financial organizations, and large corporations to create intelligent video communication systems with banking-level security and AI technologies.

How to Choose Services for SaluteJazz Ecosystem

SaluteJazz is created as part of a large Sber ecosystem with access to banking AI technologies and security standards. Service selection should maximize use of these advantages.

Integration with Sber Ecosystem Products

Sber AI platform utilization. SaluteJazz can integrate with banking AI services for natural language processing, sentiment analysis, automatic key information extraction from corporate discussions.

SberCloud infrastructure. Corporate data placement in Sber cloud infrastructure guarantees banking-level security and compliance with all Russian requirements.

Unified ecosystem authentication. Using SberID for single sign-on to all corporate services integrated with SaluteJazz.

Banking Security Standards

Central Bank of Russia requirements compliance. All integrations must comply with Bank of Russia regulation №382-P "On requirements for ensuring information protection in money transfer operations."

Banking secrecy and confidentiality. Corporate information processing according to banking secrecy standards with appropriate access levels and auditing.

Financial risk management procedures. Integration with operational risk management systems for corporate communication control.

Top 8 SaluteJazz Services: Sber Ecosystem Rating

Rating compiled considering depth of Sber ecosystem integration, banking AI technology usage, and financial security standards compliance.

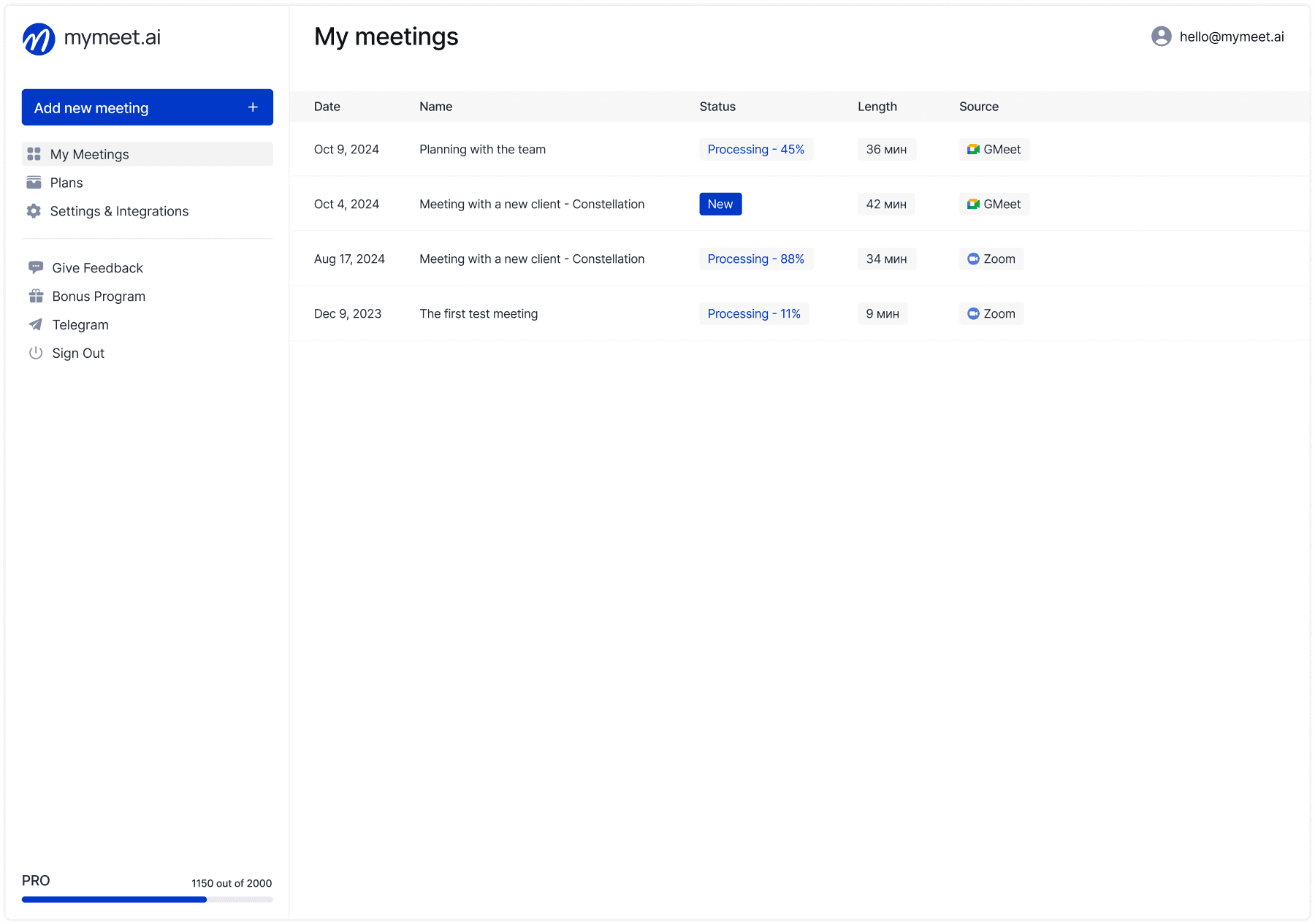

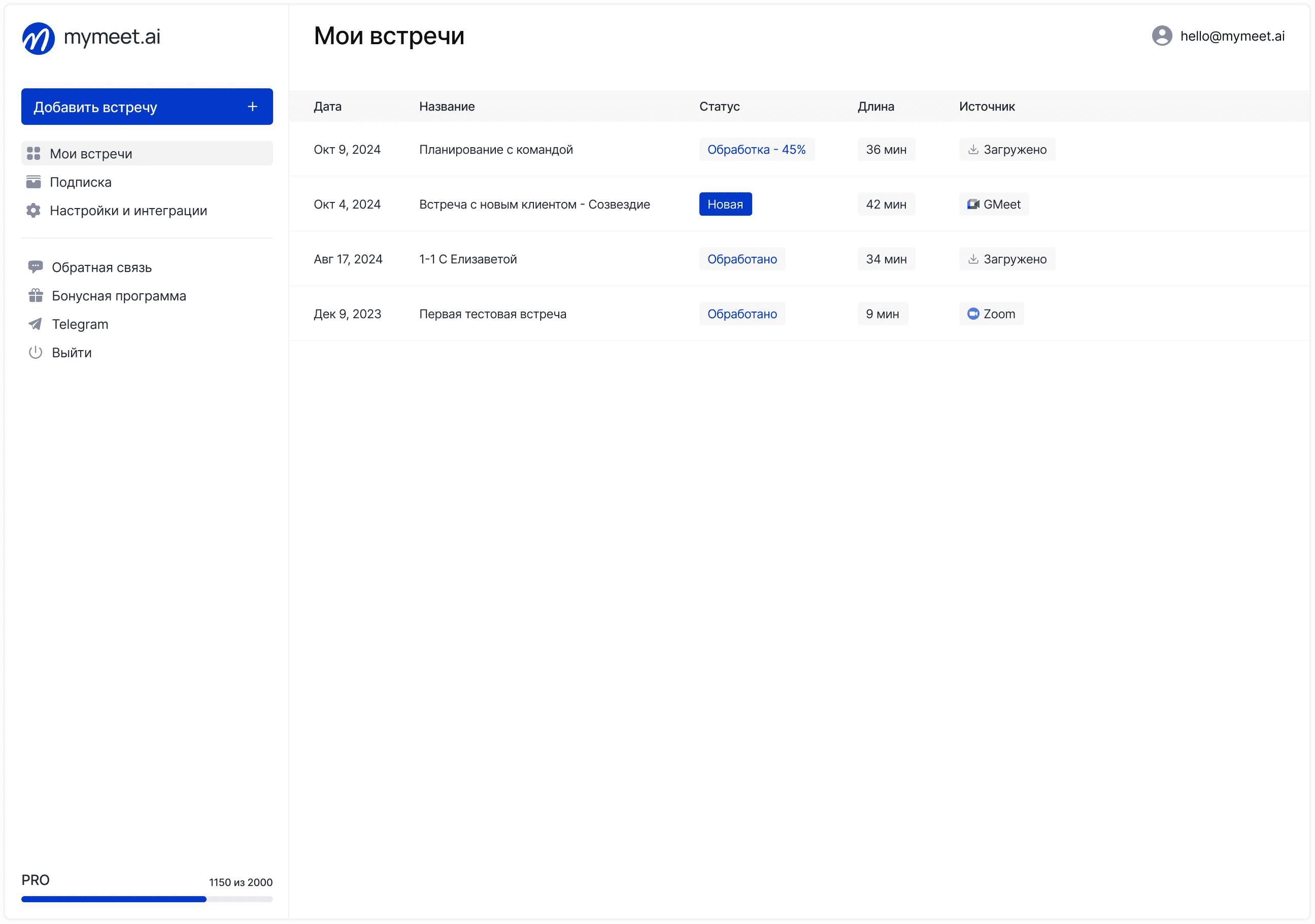

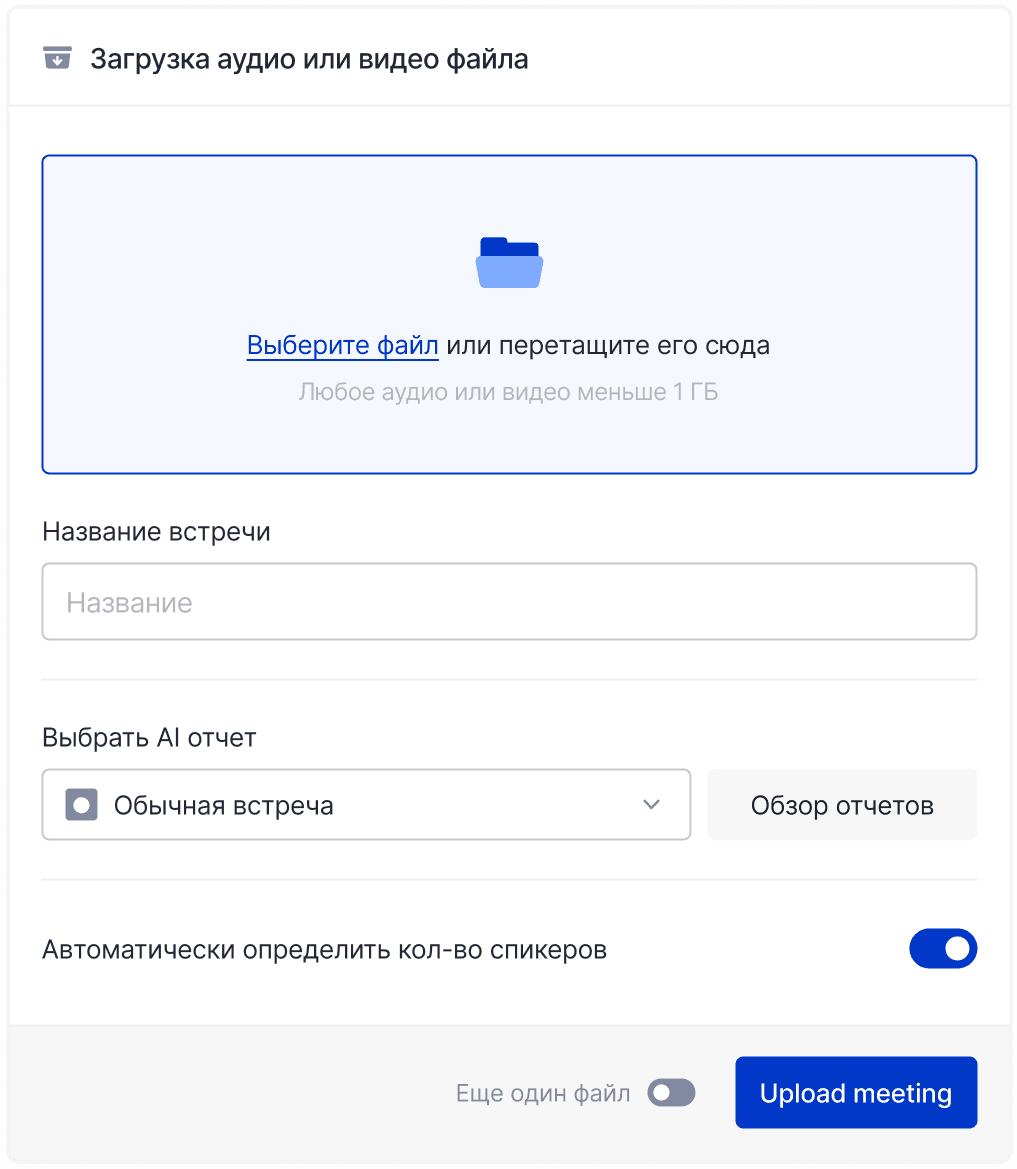

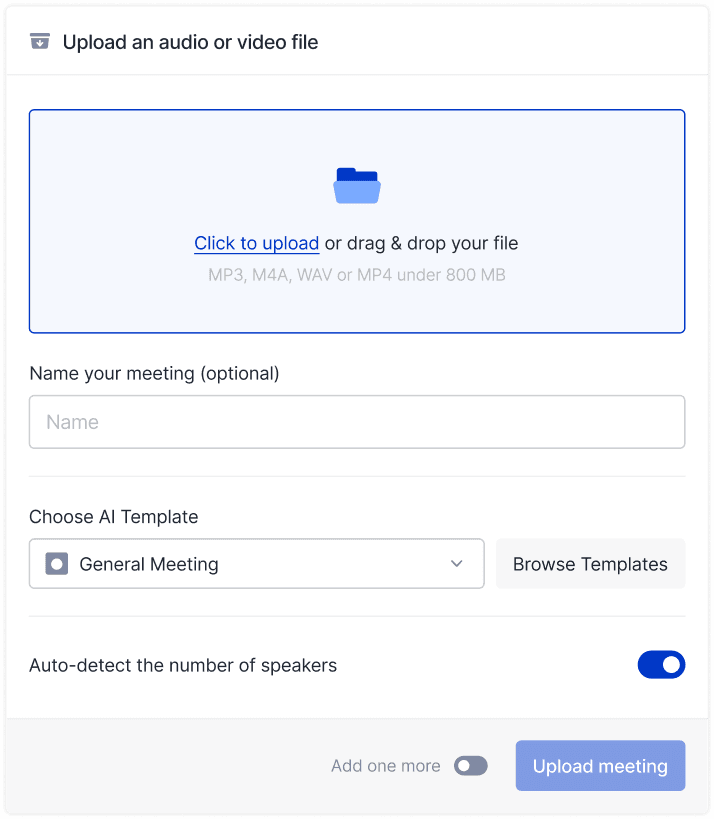

1. Mymeet.ai — Intelligent Analysis with Banking Security

The only third-party service that meets banking security standards and can integrate with financial organization corporate systems.

Key Feature: AI analysis of banking meetings with compliance to banking secrecy requirements and Central Bank standards.

Price: Banking rates from 2,500₽/month with 99.9% SLA

Pros:

Banking security standards compliance

Specialized templates for financial sector

Integration with banking risk management systems

For whom: Banks, insurance companies, investment funds, fintech startups.

2. SberCloud — Corporate Cloud Platform

Sber cloud infrastructure for corporate data placement and SaluteJazz integration with other business systems.

Key Feature: Banking-level reliability and security of cloud infrastructure with 99.95% SLA guarantee.

Price: From 0.50₽ per virtual machine hour

Pros:

Banking security standards and Federal Law 152 compliance

Deep infrastructure-level SaluteJazz integration

Russian data centers and technical support

For whom: Large corporations, banks, organizations with reliability requirements.

3. Salut AI — Artificial Intelligence for Business

Sber AI platform for creating intelligent assistants and automating corporate communication analysis.

Key Feature: Banking AI technologies for speech analysis, key decision highlighting, and automatic protocol creation.

Price: From 50₽ per 1,000 AI model requests

Pros:

Access to Sber's advanced AI developments

Russian language processing specialization

Integration with banking decision-making processes

For whom: Corporations for implementing AI assistants in business processes.

4. SberBusiness — Corporate Banking

Banking services for business with video consultation integration and remote banking service.

Key Feature: Video consultations with banking specialists directly in corporate banking interface.

Price: Within corporate service tariffs

Pros:

Integration of banking services and video consultations

Banking-level operation security

Personal managers for large business

For whom: Sberbank corporate clients, financial directors.

5. SberLogistics — Supply Chain Management

Sber logistics platform for supply chain management with video conferencing between participants.

Key Feature: Complex logistics operation coordination through video communication between all supply chain participants.

Price: From 0.5% of logistics operation cost

Pros:

Integration of logistics processes and video coordination

Real-time tracking and video reports

Banking guarantees for logistics operations

For whom: Manufacturing companies, trading networks, logistics operators.

SaluteJazz Services Comparison: Ecosystem Table

Service | Category | Price From | Sber Integration | Banking Security | Rating |

Mymeet.ai | AI Analysis | 2,500₽/month | ✅ Compatible | ✅ Complete | ⭐⭐⭐⭐⭐ |

SberCloud | Cloud | 0.50₽/hour | ✅ Native | ✅ Banking | ⭐⭐⭐⭐⭐ |

Salut AI | AI Platform | 50₽/1000 | ✅ Native | ✅ Banking | ⭐⭐⭐⭐⭐ |

SberBusiness | Banking | In tariff | ✅ Native | ✅ Banking | ⭐⭐⭐⭐ |

SberLogistics | Logistics | 0.5% of operations | ✅ Native | ✅ Banking | ⭐⭐⭐⭐ |

Mymeet.ai for SaluteJazz — Banking-Level Meeting Analysis

In the SaluteJazz ecosystem, only mymeet.ai is created for financial organizations with banking security standards compliance and understanding of financial business specifics. The only third-party solution that can operate in a banking environment.

✅ Banking security standards — compliance with Central Bank requirements and regulation №382-P on information protection

✅ Financial analysis templates — credit committees, budget reviews, risk meetings, compliance meetings

✅ Banking secrecy — confidential financial information processing with appropriate access levels

✅ Banking system integration — core banking, risk management, compliance systems

✅ Banking-level SLA — 99.9% availability guarantee and 24/7 technical support

✅ Special rates for financial organizations — preferential terms for banks and insurance companies

Case: Regional Bank Automates Credit Committees

Regional bank with 50 billion rubles assets conducts weekly credit committee meetings through SaluteJazz for large corporate loan decisions. Central Bank requirements for credit decision documentation created 8+ hours weekly burden on risk managers.

Mymeet.ai implementation results:

Automatic protocols of all credit committee meetings highlighting credit decisions, limits, risk assessments, deal conditions

Integration with bank risk management system for automatic client credit file updates

Banking efficiency: 8 hours weekly risk department savings, 80% improved Central Bank documentation quality, 40% accelerated credit decision-making through structured discussion analysis.

Implement banking AI analysis in SaluteJazz. Contact consultant through form to configure for financial regulator requirements.

SaluteJazz Integrations with Sber Ecosystem

Maximum SaluteJazz capabilities are revealed through deep integration with Sber ecosystem products and banking AI technology usage.

Integration with SberCloud and AI Platform

Salut AI for meeting analysis. Using banking AI models for automatic meeting sentiment analysis, key decision highlighting, executive summary creation for management.

SberCloud for corporate data. Placing all meeting recordings and analytical data in banking cloud infrastructure with guaranteed SLA and compliance with all security requirements.

Banking APIs and Automation

SberBusiness API integration. Automatic banking order creation and payment initiation based on financial decisions made at meetings.

Automation through SberAutomation. RPA robots automatically process meeting results, create tasks in corporate systems, and send notifications to responsible parties.

Corporate Analytics through SberData

Comprehensive communication analytics. Meeting effectiveness analysis, decision-making pattern identification, corporate communication quality assessment using banking analytical technologies.

Predictive analytics. Meeting result forecasting, participant composition optimization, recommendations for corporate communication effectiveness improvement.

SaluteJazz Configuration for Banking Security Standards

Using SaluteJazz in financial organizations requires compliance with special Central Bank requirements and banking information security standards.

Central Bank Requirements Compliance

Regulation №382-P compliance. Configuring user operation logging system, transmitted data encryption, information access control according to banking requirements.

Banking secrecy. Implementing banking secrecy protection procedures when conducting video conferences with client participation or discussing confidential financial information.

Banking Security System Integration

Banking SIEM systems. Integrating SaluteJazz logs with banking information security monitoring systems for comprehensive corporate communication control.

Fraud prevention systems. Using banking anomaly detection technologies to identify suspicious video conference activity.

Operational risk management. Integration with banking risk management systems for operational risk assessment related to corporate communications.

Conclusion: Maximize Sber Ecosystem Potential

SaluteJazz offers unique opportunities to access banking AI technologies and security standards through Sber ecosystem integration. Proper configuration of 4-6 key services will create an intelligent corporate platform.

Basic set for financial organizations:

Mymeet.ai for banking-level meeting analysis

SberCloud for reliable infrastructure

Salut AI for intelligent automation

Focus on deep Sber ecosystem integration to gain access to advanced banking technologies and world-class security standards.

Ready to implement banking AI analysis in SaluteJazz? Try mymeet.ai for the financial sector — special terms for banks and insurance companies.

Frequently Asked Questions about SaluteJazz Services

Which SaluteJazz services suit banks and financial organizations?

Mymeet.ai with banking security standards, SberCloud for infrastructure, Salut AI for intelligent analysis, SberBusiness for banking operations. All comply with Central Bank requirements and banking secrecy.

SaluteJazz integration with Sber ecosystem — what capabilities?

Access to banking AI technologies through Salut AI, SberCloud cloud infrastructure, banking APIs, automation through SberAutomation, SberData corporate analytics, SberMart trading platform.

SaluteJazz banking security — Central Bank compliance?

Full compliance with regulation №382-P, banking encryption standards, banking secrecy protection, banking SIEM system integration, compliance with all financial regulator requirements.

Cost of corporate SaluteJazz services?

Mymeet.ai from 2,500₽/month for banks, SberCloud from 0.50₽/hour, Salut AI from 50₽/1000 requests, SberAutomation from 15,000₽/robot. Special rates for financial organizations.

SaluteJazz meeting AI analysis — what technologies are available?

Sber banking AI models for natural language processing, sentiment analysis, automatic decision extraction, predictive analytics, specialized models for the financial sector.

SaluteJazz for credit organizations — special requirements?

Banking secrecy compliance, credit decision documentation, risk system integration, Central Bank requirement compliance, special procedures for client information work.

SberCloud corporate cloud infrastructure for SaluteJazz?

Banking reliability standards SLA 99.95%, Russian data centers, Federal Law 152 compliance, corporate system integration, scalability for large organizations.

Banking process automation through SaluteJazz?

SberAutomation RPA robots for meeting result processing, automatic banking order creation, core banking system integration, workflow for banking procedures.

SaluteJazz technical support for the financial sector?

Banking-level SLA 99.9%, 24/7 technical support, personal managers for large financial organizations, compliance and banking requirement consultations.

Bank migration to SaluteJazz from other video conferencing — how to ensure security?

Phased migration maintaining banking standards, Central Bank requirement compliance audit, existing banking security system integration, personnel training on banking procedures.

Andrey Shcherbina

Oct 13, 2025